Will I have to go to court because of the default notice?

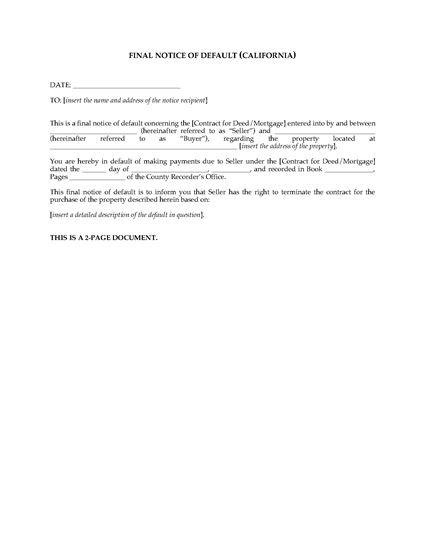

If you are struggling to make the payments and you have additional debts and want to organise your finances by entering into a debt solution then we would provide you with advice and support today on 08. If the default notice requires an immediate payment it will include instructions on how to do so if you can easily afford to pay this, then this should be paid within the time frame to limit any court action.A default notice gives the lender 7 days to comply with the action required this doesn’t always mean that you will be taken to court, but it is best to comply promptly with the instructions from the default notice to ensure the issue is resolved and that the creditor doesn’t take any further action.It is vital to act quickly and seek professional advice.Defaults are a warning and should be taken very seriously.If payments are in arrears the creditor must issue a default notice before any legal action can take place.What happens once I have received the default notice? Take our debt test to find out how we could help >

Which Debts Are Not Included In Bankruptcy?.

0 kommentar(er)

0 kommentar(er)